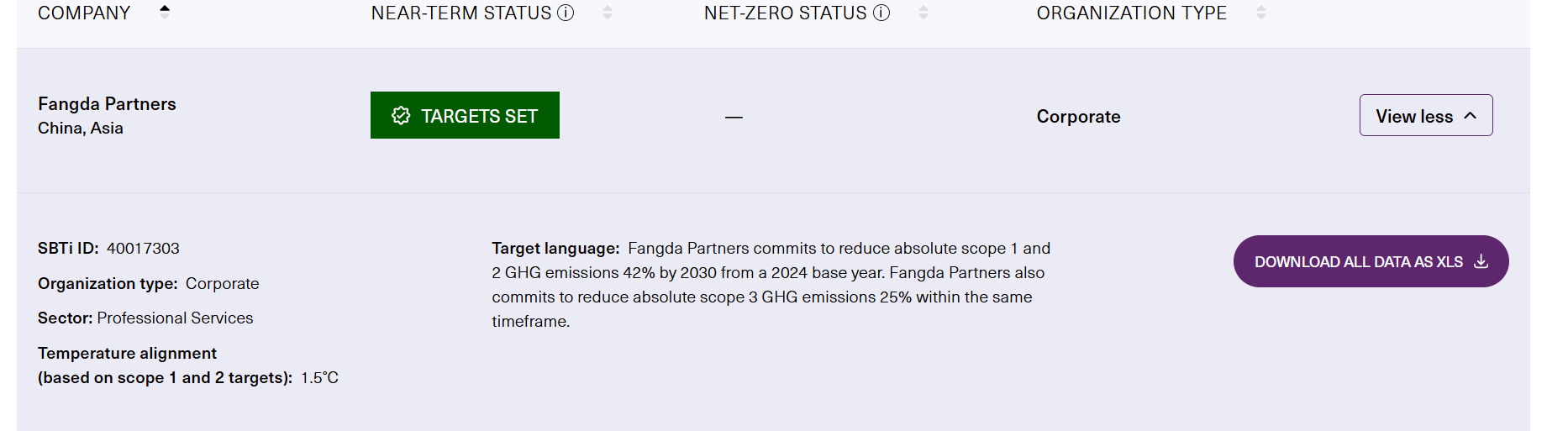

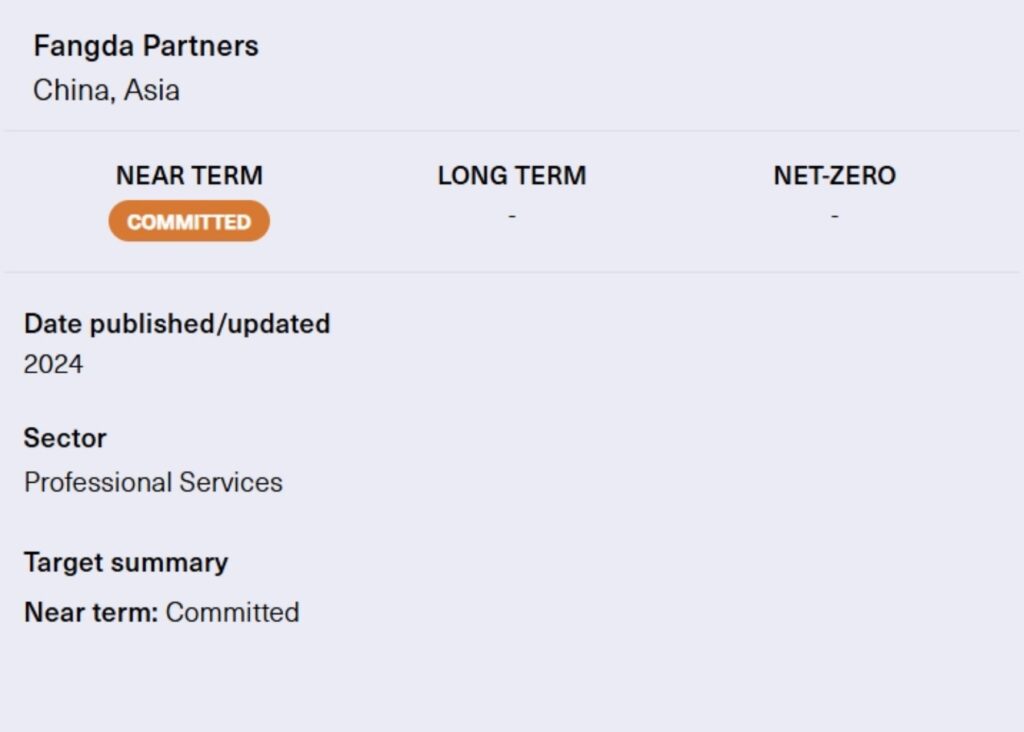

Fangda Partners is pleased to announce that the firm’s near-term greenhouse gas emissions reduction targets have been validated by the Science Based Targets initiative (SBTi), affirming that the firm’s emissions reduction targets align with the 1.5° C trajectory of the Paris Agreement. The milestone establishes Fangda as the first Chinese law firm to successfully complete the SBTi validation by following its corporate validation route, demonstrating our unwavering commitment to green transition and industry leadership.

- Fangda commits to reduce absolute scope 1 and 2 GHG emissions 42% by 2030.

- Fangda commits to reduce absolute scope 3 GHG emissions 25% by 2030.

Founded in 2015 by the World Wide Fund for Nature (WWF), CDP, World Resources Institute (WRI), and the United Nations Global Compact, SBTi is a global initiative that helps companies establish science-based emissions reduction targets aligned with 1.5°C decarbonization pathways. It strives to make setting science-based emissions reduction targets a world-wide standard business practice.

Founded in 2015 by the World Wide Fund for Nature (WWF), CDP, World Resources Institute (WRI), and the United Nations Global Compact, SBTi is a global initiative that helps companies establish science-based emissions reduction targets aligned with 1.5°C decarbonization pathways. It strives to make setting science-based emissions reduction targets a world-wide standard business practice.

- the first pre-restructuring case involving a convertible bond issuer in China

- the first — and currently only — listed company in China to fully resolve its convertible bond issues during pre-restructuring through a “voluntary conversion + early redemption” mechanism

- the first successful restructuring of a listed company in China after the issuance of the new State Council Nine-Point Guidelines (“New Nine Rules”).

- Restructuring of Dalian Shipbuilding Offshore Co., Ltd. (2021);

- Pre-restructuring to restructuring of ZK Engineering & Development Corporation Headquarters (2022);

- Recognition and assistance of the Japanese civil rehabilitation proceedings for Shanghai International Holding Co., Ltd. (2023);

- Substantive Consolidation Bankruptcy proceedings of CEFC Shanghai Group Limited (2023);

- Pre-restructuring to restructuring of Shanghai Trendzone Holding Group Co., Ltd. (2023).

- Two sustainable Panda Bond offerings by Asian Infrastructure Investment Bank with an aggregate principal amount of RMB 6 billion;

- Two Panda Bond offerings by Deutsche Bank with an aggregate principal amount of RMB 6 billion;

- Offering by BMW Group of its RMB 2 billion commercial paper, RMB 3.5 billion dual-tranche medium-term notes and RMB 1.5 billion three-year medium-term notes;

- Offering by Volkswagen Group of its RMB 1.5 billion medium-term notes;

- Offering by CSSC (Hong Kong) Shipping of its RMB 800 million medium-term notes.

Fangda represented Alibaba Group Holding Limited (“Alibaba”) as its primary deal counsel as well as its PRC and Hong Kong local law counsels for the sale of 100% equity interest in Intime (one of the leading department store operators in the PRC) by Alibaba and a minority shareholder to a consortium of purchasers comprising Youngor Group and members of Intime’s management team (the “Intime Sale”). Alibaba currently holds approximately 99% of the equity interest in Intime. The expected gross proceeds to Alibaba from the Intime Sale is approximately RMB7.4 billion. This transaction was signed on December 17, 2024 and the completion is subject to PRC merger control clearance and other customary closing conditions.

Fangda has provided comprehensive one-stop legal services to Alibaba in this transaction, including participation in the design of the transaction structure, sell side due diligence, assisting with the negotiation, drafting, revision, and finalization of transaction documents, as well as supporting the completion and related matters.

The Fangda team is led by Norman Zhong, with support from partners Helen Fan and Samuel Xie. The corporate team based in Shanghai and Hong Kong includes Yixin Zhang, Joyce Pei, Wyatt Zhang, Jingyi Li, Crystal Liu and Ellison Ma. Jeffrey Ding (partner, capital markets), Caroline Huang (partner, antitrust), Zhang Hao (partner, M&A) and Ray Xu (counsel, corporate) also provided support to this project.The H-share listed company iMotion Automotive Technology (Suzhou) Co., Ltd. (“Company” or “iMotion Technology”) successfully completed an issuance of 4,427,000 shares on the Main Board of The Stock Exchange of Hong Kong Limited (HKEX) on December 2, 2024, with proceeds primarily allocated for enhancing R&D for advanced intelligent driving and automated driving and for cockpit integrated solutions and products.

iMotion Technology focuses on the mass-market implementation of advanced driver assistance systems (ADAS). With cutting-edge autonomous driving algorithms, exceptional hardware-software integration capabilities, and extensive engineering expertise, the Company builds core technological advantages to deliver accessible, high-value intelligent mobility solutions. As a pioneering law firm for legal services in the new energy sector, Fangda Partners continues to provide comprehensive and exceptional legal support to industry clients, including new energy vehicles (NEV) manufacturers, battery producers, autonomous driving hardware makers and service providers, and supply chain players. Fangda Partners has helped iMotion Technology and other Chinese enterprises achieve key milestones and long-term business goals, witnessing their significant achievements in capital markets and becoming a loyal partner in their development. Fangda Partners acted as the PRC legal counsel to the placing agent, providing comprehensive legal services for the transaction, including the filing with the China Securities Regulatory Commission. The Fangda team was led by partners Jeffrey Ding and Brian Liu. Team members included Shi Shengjie, Jacky Yang, Jasper Gao, and Kerry Huang.Michael HAN, Chairman of the Management Committee of Fangda Partners, says, “As a fullservice Chinese law firm, Fangda places great importance on environmental, social and governance (ESG), viewing ESG as core drivers of our long-term growth. Our decision to join SBTi aligns with China’s strategic initiatives on carbon peaking and carbon neutrality. This reflects our commitment to green and sustainable development and represents Fangda’s steadfast commitment to respond to climate change alongside our clients.”

Fangda has implemented various measures to support emissions reduction and enhance sustainability, including encouraging green lifestyles and office practices among employees, promoting green public welfare activities, prioritizing environmentally friendly buildings and workspaces, and actively participating in the EcoVadis Ratings and others. While setting a sciencebased target, Fangda plans to further refine its focus on key emissions reduction initiatives, adopting practical steps to lead the Chinese legal services industry toward low-carbon development.

Fangda aims to set near-term science-based targets and submits them to the SBTi for validation by the end of 2025.

Founded in 2015 by the World Wide Fund for Nature (WWF), CDP, World Resources Institute (WRI), and the United Nations Global Compact, SBTi is a global initiative that helps companies establish science-based emissions reduction targets aligned with 1.5°C decarbonization pathways. It strives to make setting science-based emissions reduction targets a world-wide standard business practice.

The Fangda team was led by partners Jeffery Ding and Brian Liu. Team members included counsels Travis Xu and Cassie Chang, and associates Willa Fang, Arial Yuan and Lewis Liu.

- The transaction value was approximately RMB 6.65 billion. The transaction was the first time on the STAR Market Board that not only the first time on the STAR Market Board that an A-share listed company acquired another A-share listed company by cash but also the first time that acquisition involved the transfer of the controlling shareholder right. The transaction is also the largest M&A transaction between medical device companies in China to date in terms of transaction amount.

- The transaction was another large-scale industrial M&A transaction successfully facilitated by Fanda’s Greater Bay Area offices for top-tier industrial clients in the Greater Bay Area.

- Founded in March 2010, Aisen Semiconductor primarily engages in the research, development, production, and sales of electronic chemicals. Focusing on the key processes, electroplating and photolithography, in semiconductor manufacturing and packaging, the company has established two major product segments: electroplating solutions with supporting reagents and photoresist with supporting reagents. Its products find extensive applications in integrated circuits, new electronic components and display panels. Leveraging core technologies in formulation design, process preparation and application knowledge, Aisen Semiconductor offers customers integrated solutions (Turnkey) for crucial process steps to meet specific functional requirements for electronic chemicals.

- In the electroplating solutions sector, starting from traditional packaging, Aisen Semiconductor gradually expanded its business into other application areas, covering electroplating processes in fields like passive components, Printed Circuit Board (PCB), advanced packaging, wafers and photovoltaics, with significant progress in advanced processes such as 28nm and 14nm. In the photoresist products sector, Aisen Semiconductor strategically focuses on large semiconductor industry clients, achieving breakthroughs through special technology photoresist materials and gradually realizing domestic photoresist substitution through differentiated competitive strategies, with significant breakthroughs achieved in Organic Light-Emitting Diode (OLED) array manufacturing and negative thick film photoresist materials for advanced packaging. Aisen Semiconductor's downstream customers are mainly concentrated in integrated circuit packaging and new electronic component manufacturing, including domestic IC packaging and testing leaders such as Jiangsu Changjiang Electronics Technology Group, Tongfu Microelectronics Co., Ltd., Huatian Technology Group and ATX Semiconductor (Suzhou) Co., Ltd., as well as international renowned electronic component manufacturers like YAGEO Corporation and Walsin Technology Corporation. In the display panel and wafer manufacturing sectors, Aisen Semiconductor actively collaborates with leading enterprises on critical materials, including collaborations with companies such as Semiconductor Manufacturing International Corporation, Huahong Semiconductor Limited, BOE Technology Group Co., Ltd. and Visionox Company.

- The first panda bonds issued by an African issuer

- The first sustainable development sovereign panda bonds

- The first sovereign panda bonds under a guarantee structure

- Motorcomm is one of the very few Ethernet physical layer chip suppliers in Chinese Mainland that owns independent intellectual property rights and has achieved large-scale sales. It focuses on the R&D, design and sales of high-speed wired communication chips. Since its establishment, Motorcomm has always adhered to the “market-oriented, technology-driven” development strategy, with the goal of achieving high reliability, high stability and Chinese localized production of communication chip products.

- The Ethernet physical layer chip independently developed by Motorcomm is one of the essential basic chips for wired transmission in data communication. With strong R&D and design capabilities, reliable product quality and high-quality customer service, Motorcomm’s products have successfully entered Chinese local market that has been dominated by international giants for a long time in the past, targeting many well-known domestic enterprises.

- InnoCare is an innovative biopharmaceutical enterprise powered by its groundbreaking independent research and development capabilities. The company possesses comprehensive R&D and commercialization capabilities, focuses on developing drugs for the treatment of cancer and autoimmune diseases, and is committed to developing best-in-class and/or first-in-class drugs with breakthrough potentials across global markets. One of its main products, BTK inhibitor Orelabrutinib, was approved (with conditions) by the National Medical Products Administration for commercialization in December 2020, and another, Tafasitamab, has been approved for use in Bo’ao Super Hospital as an imported drug for use in clinical urgency. The company has more than 10 other products that are in Phase I/II/III clinical trials and pre-clinical stages.

- InnoCare was co-founded by Dr. Jisong Cui and Dr. Yigong Shi. The management team comprises seasoned industry executives from multinational pharmaceutical companies, bringing InnoCare with their valuable insight in drug R&D, production and commercialization.

- Hi-Trend Technology is a leading high-tech enterprise which designs, develops and sells smart metering integrated circuits in China. With its high performance, high reliability and energy-efficient products, the company has obtained a comprehensive product line and leading market position in the domestic Internet-of-Things (IOT) smart metering chip field.

- Hi-Trend Technology’s various products rank highly in both the domestic and export markets. Its “three-phase metering chips” are consistently the best seller in the domestic market, while its “single phase System on Chip (SoC) chips” achieve higher exports than others. The company’s “single phase metering chips and “smart metering Microcontroller Unit (MCU) chips” rank second in the Chinese market. The “high speed carrier communication chips” supported by the company’s core design have obtained the first batch of approval by the China State Grid with official chip-level interconnection inspection report, leading to this chip gaining promising market share in the State Grid market and being the most popular in the Chinese integrated circuit market.

- Hongjiu Fruit is a fast-growing multibrand fruit company in China sourcing its fruits mainly from China, Thailand and Vietnam with an end-to-end supply chain.

- Hongjiu Fruit focuses on developing fruit products in categories that enjoyed fast-growing market share and high consumption values in China. By sales revenue in 2021 according to CIC, it is China’s largest Southeast Asian fruit supplier, the largest durian distributor, as well as one of the top five distributors of dragon fruit, mangosteen and longan. Hongjiu Fruit is continuing its growth and expansion of its fruit business, as well as consolidating its market position and share in China’s fresh fruit sector.

- the first sustainable development bond issuance in China by a supranational issuer

- the first sustainable development bond issuance in China conducted under the issuer’s sustainable development bond framework

- the first sustainable development bond issuance by an international development institution under the pilot program for social bonds and sustainability bonds launched by the National Association of Financial Market Institutional Investors (NAFMII) of China

- acquisition of 29.99% of shares through the negotiated private transfer, completed on February 23, 2022, making Zoomlion a controlling shareholder of RoadRover Technology; and

- tender offer for an additional 23.83% of RoadRover Technology, completed on May 9, 2022.

- The first bankruptcy and restructuring case under new legislation in which the court appointed the administrator according to the request of the applicant.

- The first bankruptcy and restructuring case handled by the Bankruptcy Adjudication Tribunal of the Shanghai Pudong New Area People’s Court since its official launch on January 7, 2022.

- the first green sovereign panda bond offering in the market;

- the first green bond offering on China’s debt market under the issuer’s Green Bond Framework established on the basis of the Green Bond Principles published by the International Capital Markets Association (ICMA), with use of proceeds meeting China’s Green Bond Endorsed Projects Catalogue (2021 Edition); and

- the first green sovereign bond offering under the pilot program for social bonds and sustainability bonds launched by the National Association of Financial Market Institutional Investors of China in November 2021.

Today, BeiGene listed on the Shanghai Stock Exchange’s STAR Market, becoming the first biotech company in the world to have shares traded in Chinese mainland, in Hong Kong and on the Nasdaq Board in the U.S. The registration for listing was granted by the China Securities Regulatory Commission on 16 November, 2021.

Fangda Partners advised BeiGene throughout on its US$3.5 billion (before over-allotment option is fully exercised) initial public offering and listing on the STAR Market. Our advice covered everything from legal issues relating to red-chip companies deciding to re-list on China’s stock exchanges, corporate governance, communications with regulators and close coordination with cross-border intermediaries. The listing involved following rules on corporate governance and securities supervision in several countries and regions, as well as ensuring compliance with listing rules in the three markets.

Since the commencement of the STAR Market in 2019, there have been three stages involving the transition of red-chip companies to having their shares listed as A-shares. In the first stage was the listing of companies (such as China Resources Microelectronics Limited and Ninebot Limited) that are not listed overseas when submitting their A-share listing applications. The second stage involved the listing of companies (such as Semiconductor Manufacturing International Corporation) that are listed in Hong Kong. And in this, the third stage, companies already listed in the U.S. and Hong Kong can now have their shares listed on the STAR Market.

Fangda has been deeply involved in all the representative listings in these three stages. Our work on the first-ever triple listing of a biotech company on the NASDAQ, HKEx and STAR Market is a reflection of our expertise in all the key legal issues related to multimarket-listed red-chip companies’ listing on the STAR Market and ability to understand the requirements of regulators. Fangda is therefore ideally positioned to advise on the return of other red-chip companies listed on overseas exchanges.

The Fangda team was led by partners Jeffrey Ding and Yvette Liu and supported by associates Yuan Fang, Travis Xu, Cassie Chang, Shirley Li and Lu He.

Fangda Partners acted as the legal counsel to JPMorgan Chase and participated in the whole process from the establishment of the securities company to effecting the transfer of shares from five domestic shareholders to JP Morgan. The team was led by partner Zhiyi Ren.

MBK Partners firstly acquired an approximately 20.9% stake in CAR, and then acquired the remaining outstanding shares of CAR through a voluntary general offer and compulsory acquisition for a total consideration of approximately USD 1.1 billion. Such compulsory acquisition was completed on July 5, 2021, and CAR was delisted from the Stock Exchange of Hong Kong and became a wholly-owned subsidiary of MBK Partners on July 8, 2021.

Founded in 2005, MBK Partners is one of the largest private equity funds in Asia with over US$24 billion of capital under management. MBK Partners focuses on North Asia and has developed expertise in various industries, including consumer and retail, telecommunications and media, financial services, healthcare, logistics and industrials. The aggregate revenues of MBK Partners’ 38 portfolio companies exceed US$47.2 billion.

Fangda team was led by corporate partners Jeffry Ding, Patrick Li, banking partner Rock Wang, and antitrust partner Michael Han. Fangda team handled the PRC legal due diligence, transaction structure discussion and the review of transaction documents.

Shenchao Technology Investment Co., a wholly-owned subsidiary of Shenzhen Major Industrial Investment Group, acted as a co-investor in the Founder Group and on its acquisition of all equity previously held by the Founder Group in Founder Microelectronics in the bankruptcy restructuring of the Founder Group.

Shenzhen Major Industrial Investment Group is an investment platform for leading industries owned by the Shenzhen municipal government. Its investments focus on major industries such as integrated circuits, with the aim of empowering breakthrough technologies. Founder Microelectronics is a national high-tech enterprise engaged in the manufacturing of integrated circuit chips. It has the first 6-inch device production line in China, with business implantation of its 13 silicon carbide product series, which leaps into the front rank of the 6-inch production line in China.

Fangda’s Shenzhen and Guangzhou offices in the Greater Bay Area worked closely together to advise Shenchao Technology on all aspects of the transaction. The Fangda team is led by corporate partner Qiang Ma and dispute resolution partner Ivan Su, and the core members include Shirley Feng, Terry Ling, Kevin Liu and Jiaqi Wen.

- CMB contemplates to bring in a strategic investor JPMorgan Asset Management (Asia Pacific) Limited (“JPMAMAPL”) to increase the registered capital of CMB’s wholly owned subsidiary CMB Wealth Management Co., Ltd. (“CMB Wealth Management”) in cash;

- JPMAMAPL will make a capital contribution of around RMB2.667 billion, of which around RMB0.556 billion shall be calculated in the registered capital of CMB Wealth Management. After the capital increase, JPMAMAPL will hold 10% equity interest in CMB Wealth Management; and

- Such capital increase shall be filed with China Banking and Insurance Regulatory Commission for approval.

- the first panda bond issued by an international development institution following the implementation of new panda bond rules for foreign governments and international development institutions at the end of 2020 in China

- ADB’s largest-ever borrowing in an Asian local currency